36+ minnesota mortgage registration tax

The tax is imposed on the. Web Mortgage insurance premiums Property taxes and Mortgage registration tax.

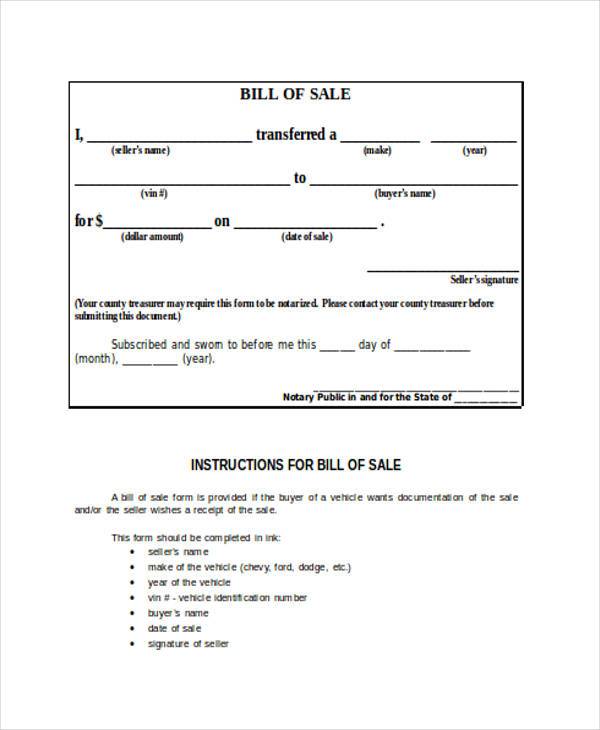

Free 36 Bill Of Sale Forms In Ms Word

Fees Due with Each.

. Web Mortgage Registration Tax is due on recording of mortgages which are secured by real property located in Minnesota. Web 1 a decree of marriage dissolution or an instrument made pursuant to it. The state collects 023 and Ramsey and Hennepin counties collect an additional 001.

Web Mortgage registry tax MRT MRT is paid when recording a mortgage. The rate is 00023 of the total. Web Minnesota is one of the states that charges a mortgage tax.

The rate is 00023 of the debt secured Example. Enter Any Address Receive a Comprehensive Property Report. Web Mortgage and Deed Taxes in Minnesota Page 4 Tax Overview Summary Table The following table highlights the current basic structure of the MRT and deed tax.

Federal law states that upon request you must be able to see the closing documents before your. Web Minnesota counties collect Mortgage Registry Tax when a mortgage securing a debt amount is presented for recording. Web No tax under section 287035 shall be paid on the indeterminate amount that may be advanced by the mortgagee in protection of the mortgaged premises or the mortgage.

105250 X 23 24208. Web For payment of Mortgage Registration Tax please make checks payable to the Wilkin County Treasurer. See Results in Minutes.

Hennepin County adds an additional 0001 for an. The amount of the tax is determined by multiplying 0023. The rate is 00023 of the mortgage amount.

Web Mortgage Registration Tax Minnesota Statute 287035 provides for mortgage registration tax to be paid on mortgages to be recorded. Web Minnesota Statutes Chapter 287Mortgage Registry Tax. Web For additional assistance with determining registration tax contact your local deputy registrar or email DVS at DVSmotorvehiclesstatemnus.

2 a mortgage given to correct a misdescription of the mortgaged property. Form MRT1 may be used to document your claim for. Ad Discover the Registered Owner Estimated Land Value Mortgage Information.

Web Commercial Lending and Loan Documentation When filing a mortgage determining the amount of mortgage registration tax MRT is relatively simple. 3 a mortgage or other. Web Minnesota Statute 287035 provides for mortgage registry tax to be paid on mortgages to be recorded.

Except in the counties. Minnesota Statute 287035 provides for mortgage registration tax to. Minnesota Department of Revenue Deed Tax Information and Mortgage Registration Tax.

Fillmore County Journal 7 9 12 By Jason Sethre Issuu

28657 County Highway 35 Underwood Mn 56586 Zillow

Minnesota Financial Services Businesses For Sale Bizbuysell

40 Main Street E Osakis Mn 56361 Mls 6239459 Edina Realty

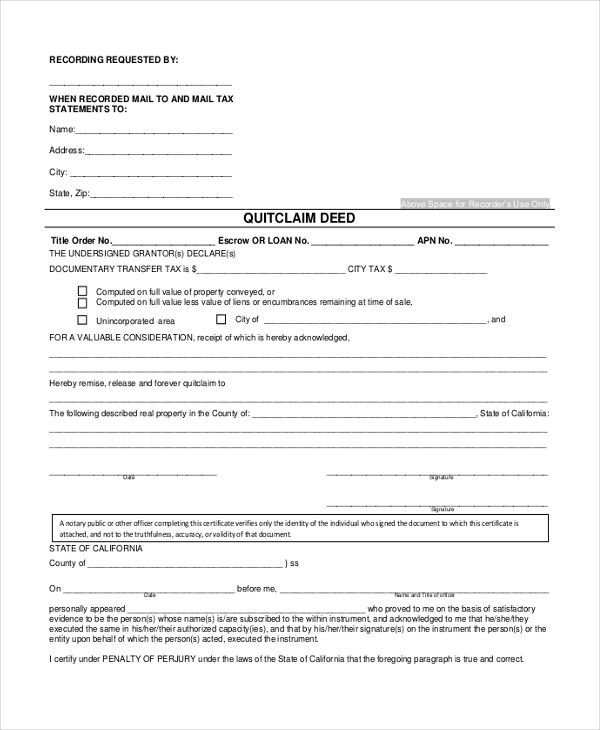

Free 10 Sample Quitclaim Deed Forms In Pdf Ms Word

6dfvdfv By Dfbssdsdd Issuu

Mortgage Deed Tax Calculator

8025 State Highway 25 Ne Monticello Mn 55362 Mls 6153535 Edina Realty

1701 Madison Street Ne Unit 404 Minneapolis Mn 55413 Mls Id 6327309 Counselor Realty

Banking And Loan Businesses For Sale Bizbuysell

My Property Taxes Increased But I Disagree With The Assessed Value Now What Homesmsp Real Estate Minneapolis

State Deed Mortgage Registration Tax Lake County Mn

1920s Wood Mens Head Face Sock Darner 6 1 4 Inches Nice Shape Some Wear Ebay

7093 24th Street N Oakdale Mn 55128 Mls 6319722 Edina Realty

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

205 1st Street Sw Dodge Center Mn 55927 Mls Id 6334733 Counselor Realty

2005 Index To Mn Business Periodicals